Comprehensive Guide to Forex Trading Training 1688107938

Comprehensive Guide to Forex Trading Training

Forex trading is a dynamic and complex endeavor that requires a solid foundation of knowledge and skill. Whether you are a beginner looking to enter the market or an experienced trader aiming to refine your strategies, effective training is crucial. In this article, we will explore various aspects of Forex trading training, including key concepts, strategies, and resources available to aspiring traders. For guidance on choosing the right trading platform, consider visiting forex trading training Brokers Argentina.

Understanding the Forex Market

The Forex market, also known as the foreign exchange or currency market, is the largest financial market in the world. With daily trading volumes exceeding $6 trillion, it offers immense opportunities for profit. However, the market’s complexity can be daunting for newcomers. Therefore, it’s essential to understand basic concepts such as currency pairs, pips, spreads, and leverage.

Currency Pairs

In Forex, currencies are traded in pairs (e.g., EUR/USD, USD/JPY). The first currency listed is the base currency, while the second is the quote currency. A trader speculates on the price movement between these two currencies. Understanding how to read quotes is fundamental to trading successfully.

Pips and Spreads

A pip is the smallest price move that a given exchange rate can make based on market convention. Most currency pairs are quoted to four decimal places, where the last digit represents one pip. The spread is the difference between the buying (ask) price and the selling (bid) price of a currency pair. Traders need to factor spreads into their trading strategy, as it affects overall profitability.

Leverage

One of the significant attractions of Forex trading is the ability to use leverage. Leverage allows traders to control larger positions with a smaller amount of capital. While leverage can amplify profits, it also increases the risk of significant losses. Thus, understanding how to use leverage responsibly is critical in Forex trading training.

Essential Skills for Successful Trading

To excel in Forex trading, certain skills are essential. Training programs should focus on these areas:

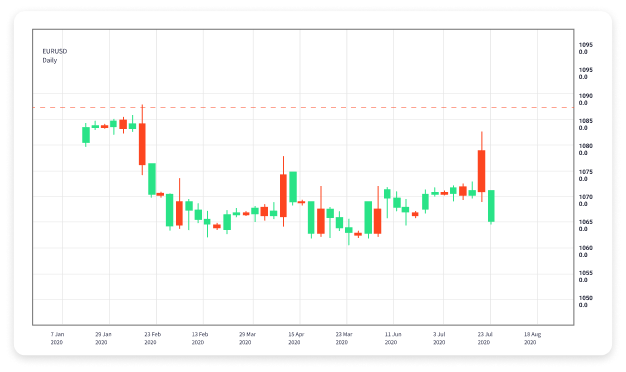

Technical Analysis

Technical analysis involves examining price charts and using various indicators to predict future price movements. Familiarity with tools such as moving averages, RSI, MACD, and Fibonacci retracements can enhance decision-making. Training should include practical chart analysis and how to develop effective trading signals.

Fundamental Analysis

Fundamental analysis focuses on economic indicators, news releases, and overall economic conditions that can affect currency values. Understanding how interest rates, inflation, and geopolitical events influence the Forex market is crucial. Aspiring traders should learn how to interpret economic calendars and news sources.

Risk Management

Effective risk management is vital for long-term success in Forex trading. This includes setting stop-loss orders, diversifying trades, and managing position sizes. Training programs must emphasize the importance of maintaining a risk-reward ratio and protecting capital.

Types of Forex Trading Strategies

Forex trading strategies vary based on time frames, goals, and trading styles. Here are some popular types:

Day Trading

Day traders open and close positions within the same day to capitalize on short-term price movements. This strategy requires quick decision-making and solid analytical skills.

Swing Trading

Swing traders aim to capture price swings over several days or weeks. This style combines technical and fundamental analysis and allows for more extended trades compared to day trading.

Scalping

Scalping involves making numerous trades throughout the day to gain small profits from minor price changes. This strategy demands constant monitoring of the market and a quick execution speed.

Choosing the Right Forex Training Program

With the increasing popularity of Forex trading, numerous training programs and courses are available. When selecting a program, consider the following factors:

Reputation

Research the credibility of the institution or individual offering the training. Look for reviews, testimonials, and a track record of successful traders.

Content Coverage

Ensure that the training program covers essential topics, including technical analysis, fundamental analysis, risk management, and psychological aspects of trading.

Practical Experience

Choose programs that offer hands-on experience, such as demo trading or simulated environments, to practice skills without risking real capital.

Continuous Learning and Improvement

The Forex market is ever-evolving, making continuous education crucial for traders. Engage in forums, read books, and follow market news to stay updated. Additionally, consider advanced courses or mentorship programs to further hone your skills.

Conclusion

Forex trading training is an ongoing journey that requires commitment and dedication. By understanding the market, mastering essential skills, and continuously improving, traders can enhance their chances of success. Whether you’re just starting or looking to refine your strategies, investing in quality training is a step toward achieving your trading goals.