Can You Deposit Dollars at Various Financial Platforms -648015842

Can You Deposit Dollars at Various Financial Platforms?

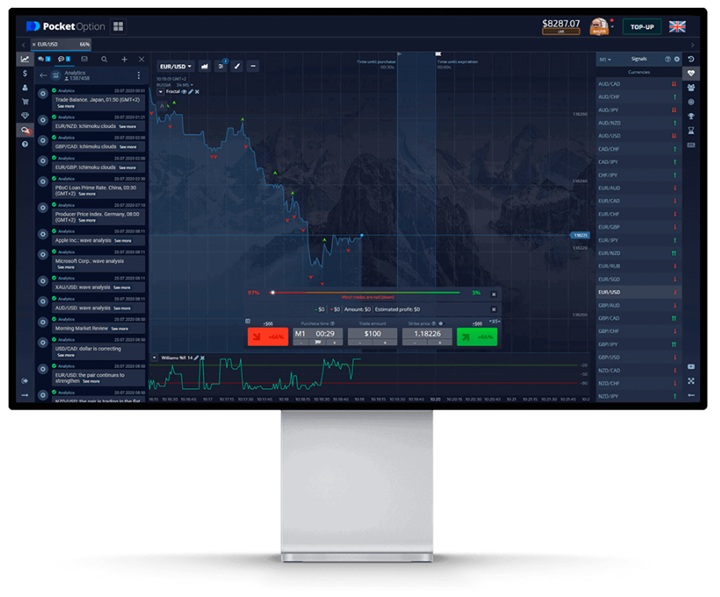

If you’re looking to deposit dollars into a trading or financial platform, you may wonder about the processes involved and whether your chosen platform accepts dollar deposits. Many financial platforms, such as can you deposit dollars at pocket option pocketoption-forex.com, provide convenient methods for users to deposit funds. This article will explore different options available for depositing dollars, the associated fees, and other considerations to keep in mind.

Understanding Dollar Deposits

Depositing dollars into financial platforms is a straightforward process, but it does come with variations depending on the platform you choose. The method of deposit can influence how quickly funds are available for trading, the fees you’ll incur, and the overall ease of the transaction. Here, we’ll take a look at some common ways to deposit dollars.

Bank Transfers

One of the most common methods for depositing dollars is through bank transfers. Most financial platforms support ACH transfers (in the United States) or wire transfers. Bank transfers tend to be secure and reliable, although they can take several business days to process, depending on the platform and your bank’s policies. It’s also important to note that some banks may charge fees for outbound wire transfers.

Credit and Debit Cards

Many platforms allow users to fund their accounts through credit and debit cards. This method is generally faster than bank transfers, with deposits often appearing instantly or within a few hours. However, users should be aware of potential fees associated with using credit cards, as some platforms may charge a percentage of the deposit amount. Additionally, some credit card issuers may classify the transaction as a cash advance, incurring further fees and interest.

e-Wallets

e-Wallet services such as PayPal, Skrill, and Neteller have become increasingly popular for depositing dollars. These platforms offer a convenient way to deposit funds into your trading account almost instantly. Users may find lower fees compared to credit card deposits, although this can vary by platform. Moreover, e-Wallets provide an added layer of privacy, as you don’t need to share your bank details directly with the trading platform.

Cryptocurrency Deposits

More recently, some platforms have started accepting cryptocurrency as a form of deposit. For users familiar with digital currencies, converting dollars to cryptocurrencies like Bitcoin and depositing them can be attractive due to lower fees and faster transaction times. However, volatility in cryptocurrency prices could be a risk for those not fully aware of the implications.

Fees and Limits

When considering how to deposit dollars, it’s crucial to review the fee structure of your chosen platform. Most platforms exhibit a transparent fee schedule, but hidden fees may sometimes apply. For example, e-Wallets and credit card transactions often include processing fees that could cut into your deposit amount. Furthermore, familiarizing yourself with deposit limits is essential. Some platforms might impose minimum or maximum deposit amounts, which can affect your initial investment strategy.

Security Considerations

Security is a top priority when it comes to financial transactions. Ensure that the platform you choose employs robust security measures such as encryption and two-factor authentication. Look for signs of regulatory compliance and industry accreditation to ensure that your funds are safe. If you’re using e-Wallets or bank transfers, understanding how those services secure transactions is equally vital.

Customer Support

In case you encounter issues while making deposits, a responsive customer support team can significantly ease the process. Research the quality of customer service offered by the platform before you commit. Effective support can aid in resolving deposit issues, whether they arise from missed transactions or technical glitches.

Conclusion

Depositing dollars into a financial platform can be accomplished through a variety of methods, from traditional bank transfers to modern e-Wallet services. Each option varies in terms of processing time, fees, and security. Before making a deposit, it’s essential to evaluate the available options and select the method that best aligns with your needs. Always prioritize security and support to ensure a smooth experience in your financial transactions.

With the right approach, depositing dollars at financial platforms can be a straightforward process, allowing you to focus more on trading and investing rather than worrying about the logistics of funding your account.